Hedera Hashgraph

Speed, Efficiency and Scalability are some of the main obstacles many organizations face when choosing a Distributed Ledger Technology. Earlier proof-of-work Blockchains consume massive amounts of energy, process transactions slowly in order to achieve security, and often are not able to scale as needed in an enterprise environment. Hedera’s breakthrough in the market was the introduction of their consensus protocol, a mathematically proven algorithm that is Abyzantine Fault Tolerant (ABT) that not only speeds consensus but still provides trustless security capabilities.

Some of the biggest challenges with Blockchain are solved with Hedra’s proof-of-stake public network powered by the Hashgraph Consensus mechanism. (Click here to download the whitepaper) Their unique algorithm powers their network and performs at over 10,000+ Transactions Per Second (TPS), offers significantly lower transaction fees equal to just fractions of a penny, and transaction confirmations within seconds. If you’re interested in implementing a DLT solution, Hedera should be on the list of potential platforms for your project.

Learn more Hedera and it’s uses below or reach out today to talk to our Disruptive Technology Group and learn what DLT options work for your needs.

The case for Distributed Ledger Technology (DLT)

There are a growing number of use cases leveraging blockchain and distributed ledger technologies (DLT). Yet not all use cases are ideally suited to this technology.

For two separate parties to transact a level of trust must be established. Creating trust isn’t straightforward, and to establish this trust requires a measured approach. DLT solutions are well suited for use cases requiring greater transparency between trading partners, be that customers and vendors, patients and physicians, or supply chain trading partners working together to build a finished product from countless pieces.

Track and Trace solutions are also well suited to blockchain technology. If the solution requires tracing or tracking physical, or non physical assets through a workflow, a DLT solution should be considered.

Using DLT to Simplify Processes and Improve Trust

Auditability is a huge driving force for DLT solutions. This is the reason many organizations in highly regulated industries such as Banking, Healthcare, Manufacturing, and Shipping and Logistics, were the first to start to develop and implement DTL based solutions in their modernization efforts. Transparency and traceability contribute to the ease of audit for solutions built with blockchain. Developers can give selective permission to parties, be they auditors, government agencies, or anyone to see the flow of parts, data, or information through a system and know with absolute mathematical certainty that the data has not been manipulated or changed from its original form in any way.

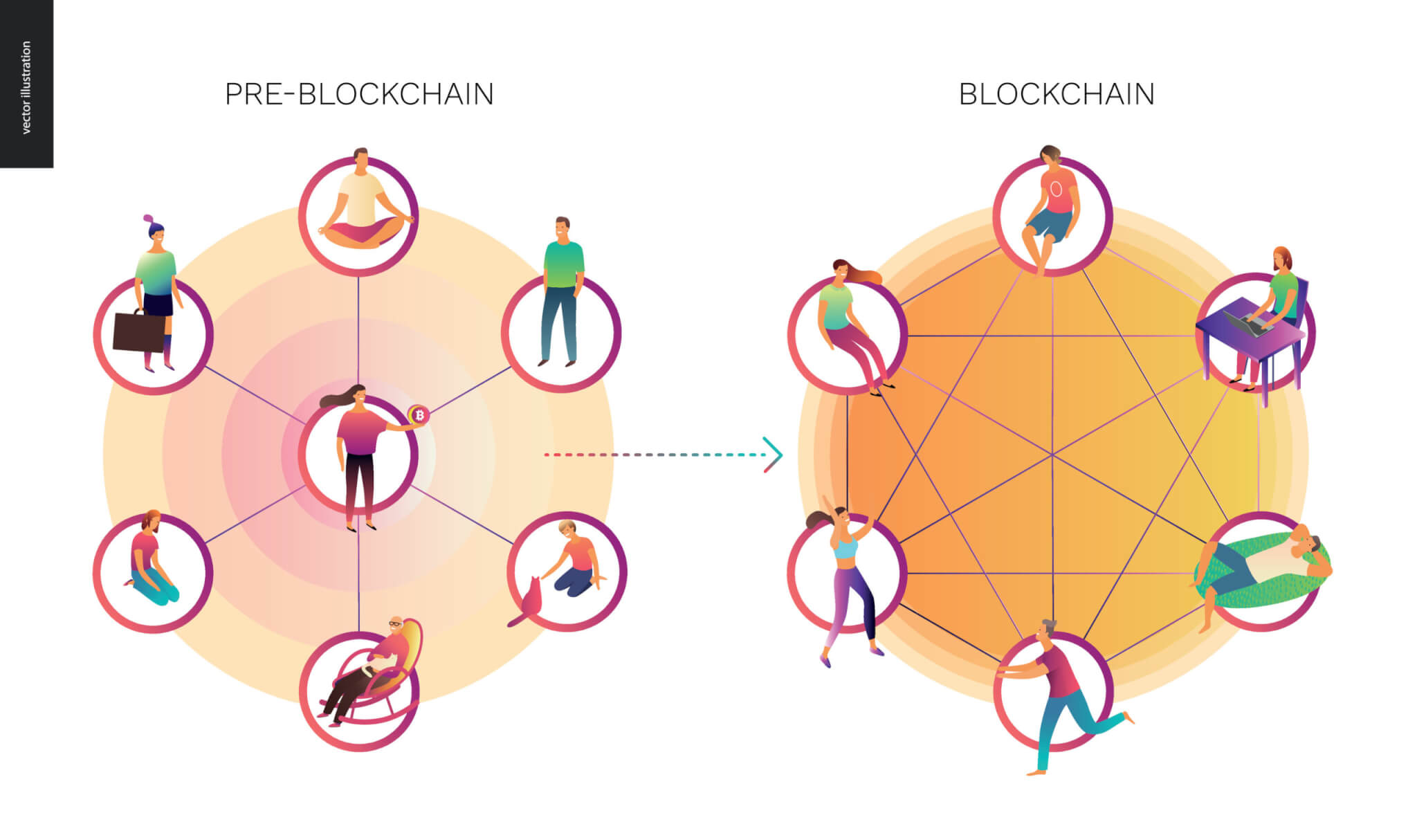

Perhaps most intriguingly is the elimination of layers of intermediaries. DLT can enable direct interaction between business partners traditionally forced to engage with third parties for financial clearing. This references, to some extent, the alpha use case of DLT which was, of course, bitcoin, which allowed anyone to transact peer-to-peer, across borders, without banks or financial clearinghouses.

There are, however, a number of complications DLT introduces. Not necessarily challenges, just elements requiring a different way of thinking about software building. These can include speed, latency, as well as data storage. This is not a case of giving something up to gain something new, rather a fundamental shift in some of the concepts traditionally software developers and database admins have had to deal with. This is why it’s important to work with an experienced partner like TxMQ who understands the nuances between using traditional technologies vs newer disruptive technologies like DLT and what works best for your objective.

Centralization vs Decentralization

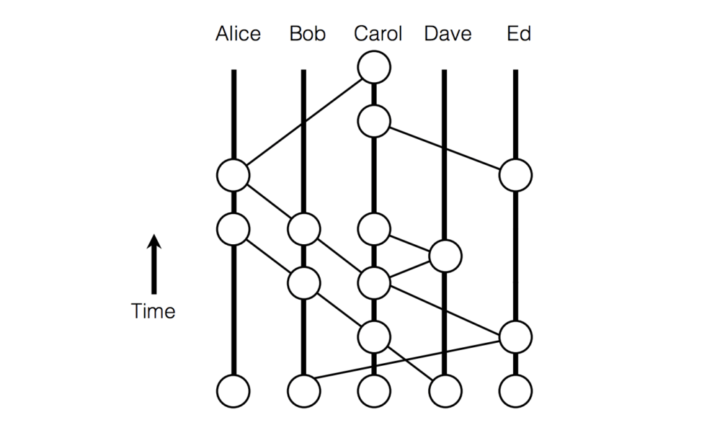

One of the primary tenets of DLT is the concept of decentralization of data. Allowing multiple nodes to hold data vs a central or singular database is a difficult concept for many to grasp, and yet ultimately very simple in practice. Yet this does introduce design changes to the architecture of DLT applications. In contrast to distributed databases, where changes made in one instance are replicated to other instances, DLT relies on the network coming to agreement on which a transaction will be applied and in what order first, before the data is accepted by the nodes. This prevents problems like the ability to double-spend.

TxMQ works with many DLT platforms, some blockchain based like Ethereum, others like Hedera Hashgraph, are graph based, or DAGs (Directed Acyclic Graphs). Which is a visual representation more so than a technical one (there is, in fact, no actual graph, while in blockchain, there actually is a chain of blocks of data).

- Prepare and organize data

- Catalog, analyze and deliver business ready data

- Build and train AI models

- Turn machine learning insights into improved actions. IBM Watson Studio can help you build AI models to run on your desktop, IBM Cloud, or any cloud.

- Deploy and run AI models

- Flexibly scale and deploy AI anywhere and avoid lock in. IBM Machine Learning lets you run models with a single click.

- Manage and operate AI

- Minimize risk by debiasing models, explaining outcomes, and correcting model drift.

Hedera Digital Payments and Transactions

Many blockchain systems have high transaction costs, making smaller transaction processing cost prohibitive. So much so that the advantage of eliminating third party payment clearinghouses is no longer a cost saving benefit.

Hedera uses it’s native cryptocurrency the Hbar to power DApps (Decentralized Applications), peer-to-peer payments, and micropayment business models. Hedera has near microscopic payments for network settlement, meaning newer use cases like micropayments of sub dollar amounts can be considered.

Instant settlements

Hbar transactions take seconds to complete, making cryptocurrency a viable option for any type of customer whether in-person or online. In contrast, Bitcoin can take up to 10 minutes and sometimes over a day to settle, reducing its uses considerably.

Increase margins

By relying on public ledgers instead of third party payment processors you can drastically reduce your resulting costs to a small, flat fee. boosting your margins on every transaction.

Unlock revenue

Low costs make the ability to transact with as little as a fraction of a cent economically viable. Opening new potential experiences and revenue streams.

Digital Identity

One of the most exciting uses for Hedera, or any DLT lies within the aspect of identity. Anonymity and security are often the driving force, pushing for adoption of Digital ID’s and most platforms have not been able to create an effective solution for transacting in a trustless environment.

Manage credentials on Hedera

Credentials capture identity attributes, skills, and qualifications and so determine authorization to data, software and systems. Key moments in a credential’s lifecycle can be recorded using Hedera Consensus Service to add transparency and certainty for each stage. Take a closer look at how we helped a medical credentialing organization drastically decrease the time it takes verify credentials for medical staff placement. (link to Intiva Case Study)

Open standards

Hedera’s credentials follow the decentralized identifier and verifiable credentials standards under development at the W3C.

Empower users

Credentials on a decentralized network can give users greater control over what, when, and to whom their identity attributes are shared.

Scale to IoT

Hedera Consensus Service can scale to support high-volume device identity use cases. An essential feature for keeping track of your valuable IoT data.

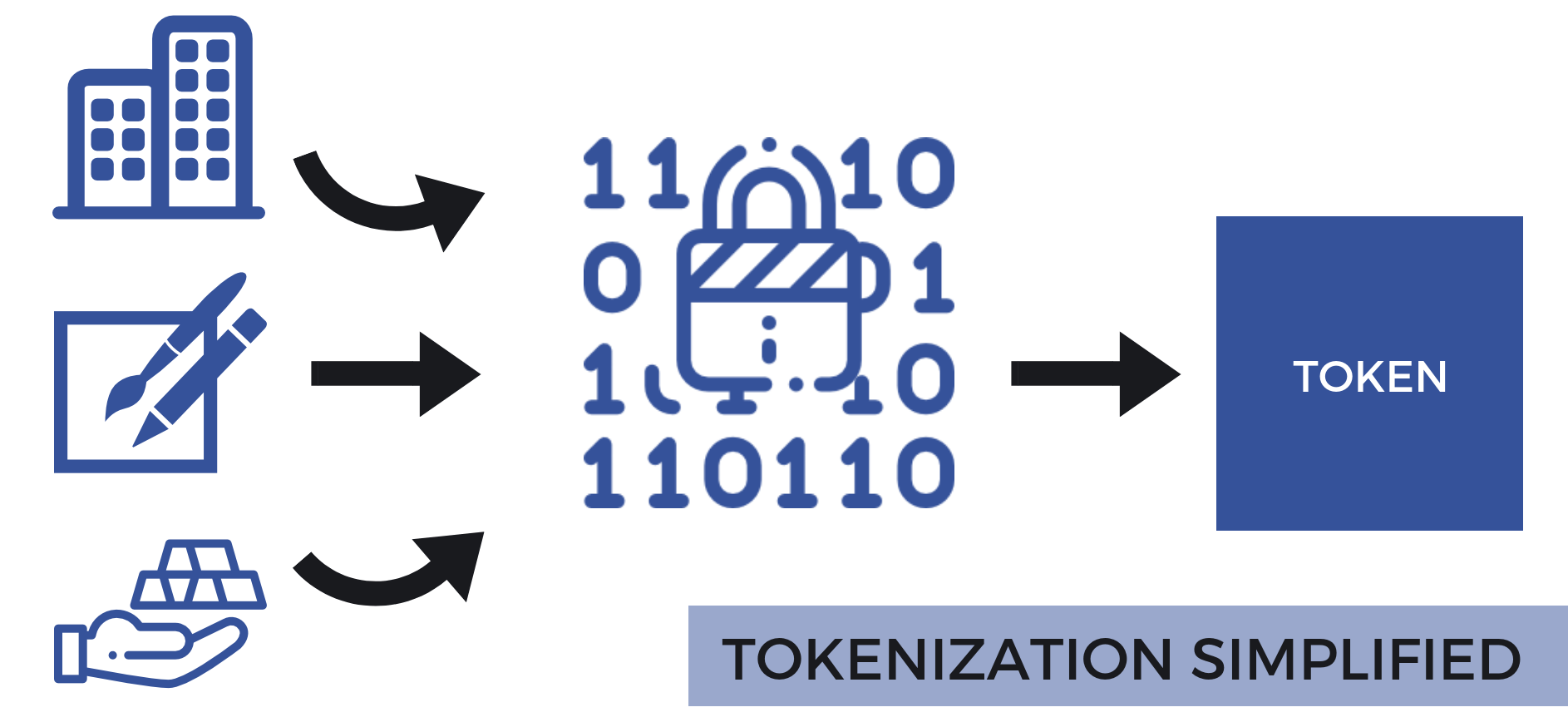

Tokenized assets on Hedera

Brokerages, transfer agents, and other financial intermediaries have turned asset creation into a slow and costly process, often vulnerable to fraud. Using smart contracts to tokenize assets on Hedera provides developers with a stable platform to build solutions across law, finance, gaming, and more.

Generate liquidity

Tokenizing assets on Hedera using existing Solidity smart contracts and ERC standards for fungible and non-fungible tokens makes it easy to both create new markets, as well as new business models.

Remove intermediaries

When exchanging property multiple intermediaries are often required to update its ownership. By conducting this process with smart contracts, ownership can be managed without costly 3rd parties to save time and cost.

Build with confidence

Hedera’s public ledger offers the highest grade of security in its class and cannot fork into a competing network – ensuring you and your users will never have to worry about multiple and contradictory representations of asset ownership.

Put users in control of compliance

Regulatory laws, policies, and compliance regulations are steadily accumulating as the world becomes increasingly digital. This is forcing companies to take data compliance seriously and improve auditability of transactions and processes. Today, proving actions to customers takes a leap of faith on their part. There is no objective way to prove to the customer that data has been handled and enforced appropriately. The solution is to amplify trust around data compliance by providing a publicly auditable log of actions taken and to provide tools to consumers to audit their own data.

Reduce liability

Choose to selectively allow auditors, regulators, and partners the ability to verify user requests and your organization’s response with a transparent set of records.

Protect brands

Reputation is everything to your brand. Mishandling customer data, and not being responsive to requests, can lead to a loss of reputation. Build and enhance trust in your brand by providing tools to customers to audit your data compliance actions on their data.

Simplify auditing

Simplify complex and manual auditing processes through data standards and real-time public verifiability, while removing costly third-party intermediaries.

Brokerages, transfer agents, and other financial intermediaries have turned asset creation into a slow and costly process, often vulnerable to fraud. Using smart contracts to tokenize assets on Hedera provides developers with a stable platform to build solutions across law, finance, gaming, and more.

Mitigating Fraud with Hedera Hashgraph

Applications today are controlled by the companies that own them, with backend infrastructure susceptible to infiltration and data tampering by both internal and external actors. As application parties are added, such as users, auditors, administrators, and more, it’s nearly impossible to ensure that everyone can be both trusted and have access to the same information in real-time. Catching fraudulent activities or transactions in real-time can significantly reduce cost and your overall losses.

Hedera enables high-throughput, verifiable logging of business transactions, as well as decentralized identifiers that adhere to the W3C Decentralized Identifier (DID) standards, for any new or existing application. This ensures all participants are trusted and associated systems have a real-time view of transactions used for predictive analysis and detection of fraudulent activities.

Reduce costs

Digital fraud accounts for over $600 billion, or 0.8% of global GDP, through losses, reputational damage, and more. Reduce costs by ensuring real-time data congruence and standards between parties, while enhancing the ability to catch fraud before it happens.

Enhance brand

Delayed disclosures and lack of real-time detection of malicious activities result in reputational damage. Enhance customer trust and loyalty by bolstering existing fraud detection systems through real-time and publicly auditable, timestamped logs.

Protect customers

The most impactful fraud mitigation often requires transparency and aggregation of data across disparate organizations. Empower fraud detection systems with the support of data standards and real-time verifiability, while still protecting customer privacy and PII.